Legal Analysis of Employee Wage Claims in Corporate Bankruptcy Procedures

Introduction: In corporate bankruptcies, employee claims are relatively small compared to general creditors, often not receiving adequate attention from the bankruptcy administrators. However, they are crucial for each employee and, from a societal perspective, are a significant concern for social stability.

This article discusses the definition of the problem.

Bankruptcy employee claims refer to the total sum of various claims that employees have against the employer due to labor relations before the bankruptcy declaration. The 1986 version of the bankruptcy law (now obsolete) limited the scope of employee claims to only wages and labor insurance costs. However, the current bankruptcy law, Article 113, defines employee claims to include not only wages but also medical expenses, disability assistance, condolence expenses, amounts owed to the employee's individual accounts for basic pension insurance and basic medical insurance, as well as compensation that should be paid to employees according to laws and regulations.

This article only discusses certain aspects of employee wage claims within employee claims, excluding other employee claim issues.

一、Analysis of the Timing and Nature of Employee Wages in Bankrupt Enterprises The amount of employee wages is primarily an issue of the calculation cutoff date for employee wages.

In practice, many people simplistically believe that wages do not need to be paid from the day the company goes bankrupt. I have encountered cases where some administrators believe that after the company ceases operations and no longer pays wages, and the employees have not worked, the labor relationship naturally terminates, and labor relations cease to exist. Others believe that if the employees do not apply for labor arbitration within a year after the wage suspension, exceeding the labor arbitration statute of limitations, they are not obligated to consider the employee's claims for back wages and economic compensation.

All of these views are incorrect. The termination of labor relations requires a clear and mutual expression of intent by both parties. In other words, unless the company or the administrator expressly states the termination of the labor contract to the employee, the labor contract is terminated from the date the employee receives the written notice of termination. After that, wages are no longer calculated, and only issues related to economic compensation are considered. Of course, it is also possible for the employee to propose the termination of the labor contract, and the termination of the labor contract relationship becomes effective from the date the company receives the termination notice. However, if neither party has clearly expressed the termination of the labor contract, the labor contract relationship will not terminate automatically. Therefore, the view that the labor contract automatically terminates after production stops is not valid.

Will the labor contract relationship terminate automatically? Definitely not. Article 44 of the Labor Contract Law clearly states the six circumstances under which a labor contract is terminated: (1) Expiry of the term of the labor contract; (2) The employee begins to receive basic pension insurance benefits in accordance with the law; (3) The employee dies or is declared dead or missing by a people's court; (4) The employer is legally declared bankrupt; (5) The employer has its business license revoked, is ordered to close or dissolve, or the employer decides to dissolve in advance; (6) Other circumstances as stipulated by laws and administrative regulations.

Therefore, the labor contract relationship will only terminate if it meets the above conditions, and concerning bankruptcy, the explicit provision is the declaration of bankruptcy.

In summary, the cutoff date for employee wages in employee claims should be based on the date of termination of the labor relationship (whichever party's expression of intent to terminate the labor contract is received first) or the date on which the grounds for terminating the labor contract occur. There are different interpretations in practice regarding the termination of labor relations in the bankruptcy process. Some believe it should be based on the date the court accepts the bankruptcy, while others believe it should be based on the date the court declares bankruptcy.

A case that supports the view that the date of acceptance of bankruptcy by the court should be considered is: Yangjiang Intermediate People's Court (2016) Yue 17 Min Zhong 608 (Judgment of the Second Civil Trial of Dispute over Confirmation of Employee Bankruptcy Claims between Zhong Liangguo and Guangdong Yangjiang Longda Group Co., Ltd.). The court in this case stated: Article 44, Article 45, and Article 46 of the Bankruptcy Law respectively provide clear provisions on the time when creditors exercise their rights, the deadline for debt claims, and the handling of undisputed claims, setting the time points as the acceptance of the bankruptcy application. Although Article 48, paragraph 2 of the Bankruptcy Law states that the claims of employees do not need to be declared, but are investigated and listed by the administrators and made public, there is an issue regarding the starting and ending points for calculating seniority in the process of listing. Therefore, only by taking the date of acceptance of bankruptcy as the endpoint for seniority calculation can we accurately list the economic compensation, that is, determine the employee's claim.

A case that supports the view that the date of the court's declaration of bankruptcy should be considered is: Supreme People's Court (2014) Min Shen Zi No. 2181 Civil Ruling. The Supreme People's Court stated: According to Article 44, Item 4 of the Labor Contract Law of the People's Republic of China, if the employer is declared bankrupt according to law, the labor contract is terminated.

I agree with the second view. The cutoff date for employee wage claims should be based on the date of the court's declaration of bankruptcy.

Because the Bankruptcy Law does not clearly specify the termination date of the labor relationship, and Article 44 of the Labor Contract Law clearly states: termination of the labor relationship upon the declaration of bankruptcy.

The Supreme People's Court, in its reply on "the deadline for payment of various social insurance pooling fees after the bankruptcy of enterprises participating in social insurance" (Judicial Reply [1996] No. 17), explicitly stated: For enterprises participating in social insurance that go bankrupt, the arrears of social insurance pooling fees should be paid until the date when the court declares bankruptcy.

The General Office of the Ministry of Labor and Social Security replied to the issue of whether social insurance premiums should be paid during the self-rescue period of bankrupt enterprises (Labor and Social Affairs Office Reply [2001] No. 286), stating: According to the reply by the Supreme People's Court regarding "for enterprises participating in social insurance that go bankrupt, the arrears of social insurance pooling fees should be paid until the date when the court declares bankruptcy" (Reply [1996] No. 17), it is clear that the arrears of social insurance pooling fees should be paid until the date when the court declares bankruptcy. Based on the above, the cutoff date for calculating employee wages should be the date when the court declares bankruptcy.

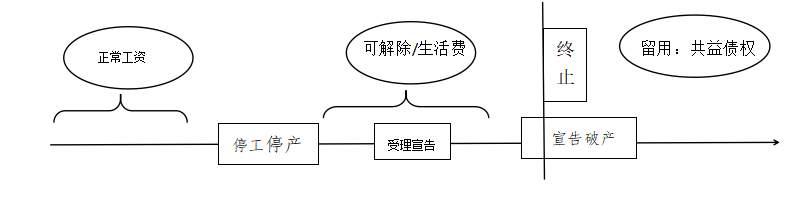

二、The Nature of Employee Living Expenses In terms of the timing, employee wages can be divided into three stages

before work stoppage, it is regular wages; after work stoppage and before bankruptcy, it is referred to as employee living expenses; and after the bankruptcy declaration, it is the wages for retained employees:

Legal Basis: Article 12 of the "Interim Regulations on Wage Payment" by the Ministry of Human Resources and Social Security: If the unit stops work or production not due to the worker's fault within one wage payment cycle, the unit shall pay the worker wages in accordance with the standards stipulated in the labor contract. If it exceeds one wage payment cycle and the worker provides normal labor, the labor compensation to the worker shall not be lower than the local minimum wage standard; if the worker does not provide normal labor, it shall be handled in accordance with relevant national regulations. Article 25, paragraph 2 of the "Shaanxi Province Enterprise Wage Payment Regulations" by the Standing Committee of the Shaanxi Provincial People's Congress: If the employer suspends production or business operations and exceeds one wage payment cycle without resolving the labor contract and not arranging work for the worker, it shall pay the worker living expenses not lower than 75% of the local minimum wage standard.

Based on the above provisions, during this period: if the worker provides normal labor, the compensation to the worker shall not be lower than the local minimum wage standard; if the worker does not provide normal labor, the employer shall pay the worker living expenses not lower than 75% of the local minimum wage standard.

If the worker provides normal labor, there is no doubt that the payment should be considered as wages. In this case, there is no need for declaration, but the administrator needs to investigate and calculate. However, if there is no work arranged even after one wage payment cycle, the worker should be paid not less than 75% of the local minimum wage standard as living expenses. From a nature perspective, what is it? If it is considered as wages, it has priority and is directly investigated and calculated by the administrator. If it is not considered as wages, it becomes an ordinary claim, requiring declaration and losing its priority.

The law does not provide a clear explanation for this. In the labor law academic community, this kind of living expenses is usually regarded as wages. From the perspective of bankruptcy law, we also believe that this portion of the worker's living expenses should be considered as special circumstances of wages. This is beneficial for social stability and aligns with the legislative intent.

三、Nature of Retained Employee Wages After Bankruptcy Declaration After a company is declared bankrupt

If the bankrupt company continues to operate with the approval of the administrator or retains employees to protect corporate assets, the wages paid cannot be considered as wages from the perspective of labor law, as mentioned earlier, the labor relationship has already terminated from the day the employer is declared bankrupt.

From the perspective of bankruptcy law, this no longer falls under employee claims but becomes a higher-level communal benefit claim. Because the purpose of retaining employees to continue working or guarding the property has turned into a common interest for everyone. Article 42 of the Bankruptcy Law stipulates that labor remuneration, social insurance fees, and other debts to be paid by the debtor for continuing the business shall be communal debts.

The above is a compilation by the author on certain issues regarding employee wage claims in bankruptcy cases.